“The US consumer seems to have entered into a state of perpetual economic gloom. Some companies seem all too eager to follow them into the abyss” – Futurist Jim Carroll

Here we go again!

I seem to spend a lot of time talking companies off the ledge, and I might be doing this again next week in Fort Worth, Texas.

I will be speaking at an event with a room full of retailers – many of the largest in both locations and sales volume throughout the country. I’ve been asked to focus on a variety of future trends including consumer sentiment. And in that context, can’t help but be cognizant of the headlines coming out after a report last week.

55% believe the economy is shrinking, and 56% think the US is experiencing a recession, though the broadest measure of the economy, gross domestic product (GDP), has been growing.

49% believe the S&P 500 stock market index is down for the year, though the index went up about 24% in 2023 and is up more than 12% this year.

49% believe that unemployment is at a 50-year high, though the unemployment rate has been under 4%, a near 50-year low.

Majority of Americans wrongly believe US is in recession

The Guardian, May 22, 2024

Simply put – most people think things are pretty bad, when they are in reality, really good. The result is that the same old warning signs used over and over and over again are flashing – again.

The consumer slowdown is here and it’s flashing a recession warning for the economy

Yahoo Finance, May 16, 2024

I won’t bother going into the reason for this mindset – it’s all quite obvious – but the fact is, based on such thinking, many US companies are already thinking once again of pulling in the reins on spending, innovation, and growth – which is exactly the wrong thing to do. After all, banks are warning them!

You will know, of course, that we’ve been here many times before.

Indeed, the headlines at the start of 2023 were that a recession was inevitable, and by the end of the year, switched to noting that it was the year that the forecasted recession never arrived. 2022? There was going to be a recession! It didn’t quite happen.

And so I reach back into the vaults and pull out some previous guidance that is just so important to share once again – in this case, a post from late 2022 when I had to talk everyone off the ledge (again.)

Sigh.

There might be a recession in 2023. Or, maybe not!

But whatever happens, an increasing number of CEOs are certainly deciding that they choose not to take part. They’ll opt out. That’s trend #6 of my ‘23 Trends for 2023′ series.

To opt-out is to choose not to participate in something.

Right now, the conventional wisdom – the wisdom of crowds – seems to be that if we are headed for a recession in 2023, we’d better hunker down, scale back, slow down, take it easy, be cautious, reduce spending, defer our actions, wait it out, take things slow, put things on pause.

And that is just plain idiotic. History tells us so – because those who choose to opt-out of conventional wisdom are those who win.

The trend that will unfold in 2023 has to do with the decision by many to choose not to participate in the current or upcoming recession, economic downturn, or whatever we want to call this period of economic uncertainty. We don’t really know if we are in a recession – one moment we seem to be, the next moment not. Clearly, it’s pretty volatile out there and uncertainty rules our future. In the context of that, it’s important to focus on the long-term goal, not the short-term volatility.

Because history tells us so!

What We Know from Previous Downturns

Several of my talks in 2022 focused on this theme, and used some powerful insight gathered during my preparatory research based on a theme I was already sharing after the 2001 and 2008 economic downturns: long-term winners are those who chose not to participate in the downturn! It seems simple but is pretty critical – when uncertainty stares you in the face, double down on innovation and transformation, and refocus on the long-term view!

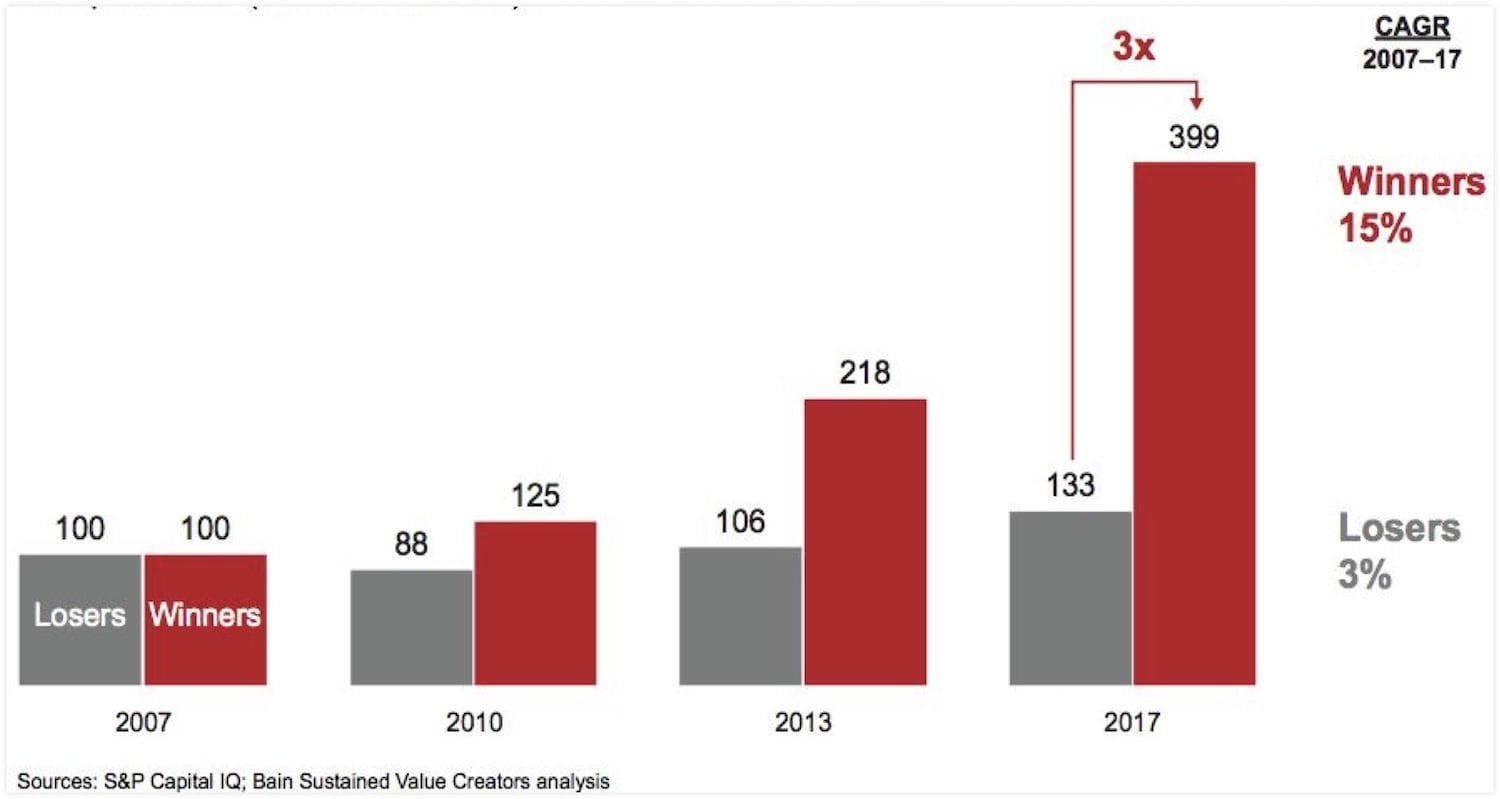

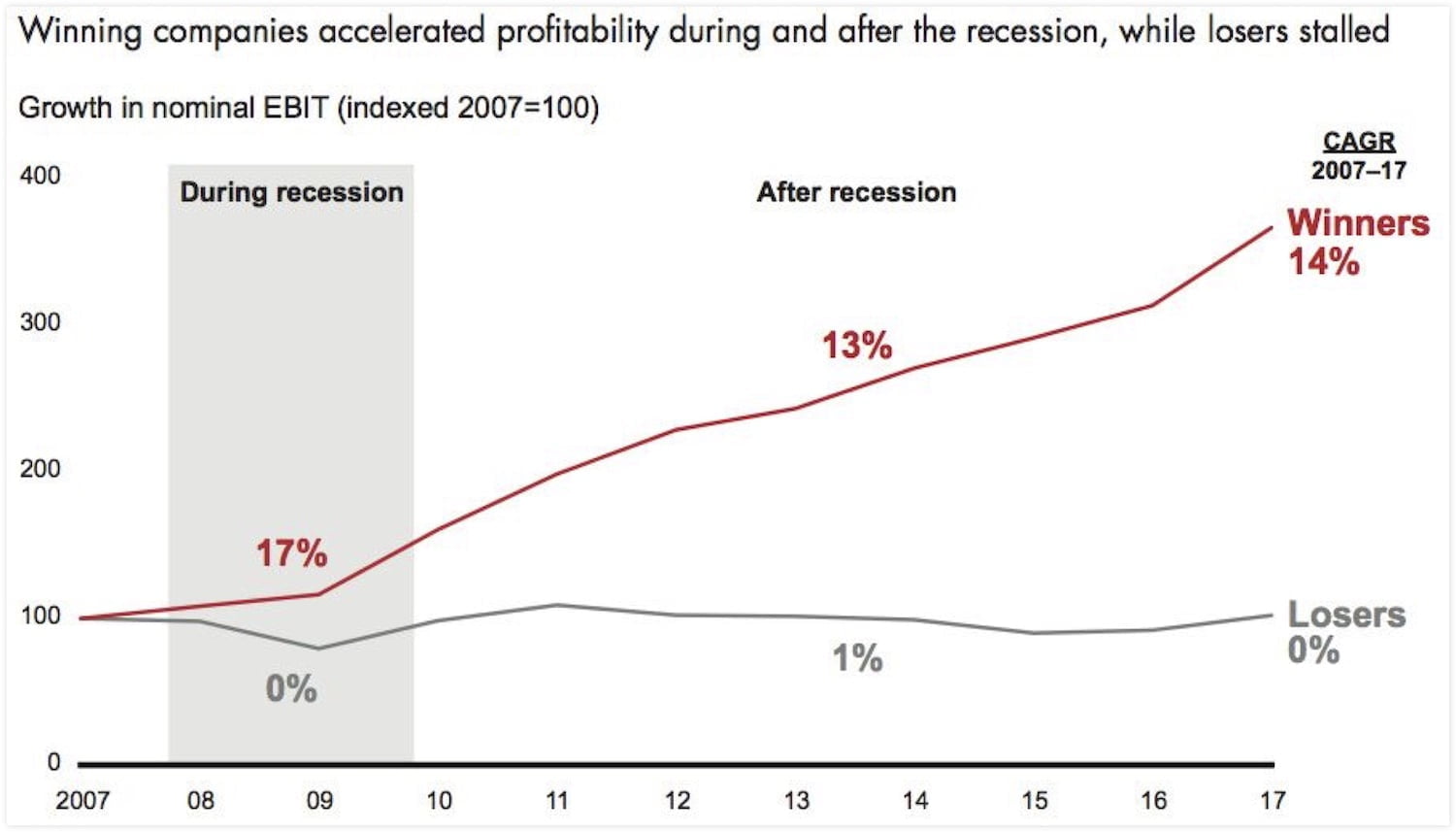

Here are two key things we learned from the 2008-09 global economic meltdown. First, ‘winners’ grew at a 17% compound annual growth rate during the downturn compared to 0% among the ‘losers.’

Second, those ‘winners’ locked in gains of 13% CAGR in the years after the downturn compared to the ‘losers’ stalling at 1%.

In other words, by opting out of the common narrative – ‘it’s a recession, cut back, hunker down and make sure you ride it out – and by choosing instead to go into the future full throttle, they emerged much better positioned for that future.

GET IN TOUCH

Jim's Facebook page

You'll find Jim's latest videos on Youtube

Mastodon. What's on Jim's mind? Check his feed!

LinkedIn - reach out to Jim for a professional connection!

Flickr! Get inspired! A massive archive of all of Jim's daily inspirational quotes!

Instagram - the home for Jim's motivational mind!