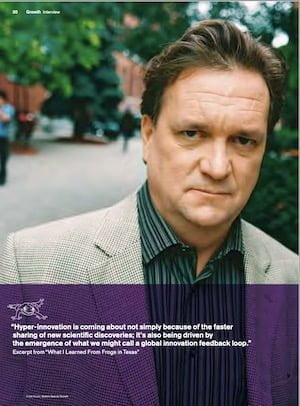

Back in 2008, just before the global economic meltdown, Credit Suisse (just purchased by UBS) interviewed me for its’ global client publication Bulletin. Distributed to 150,000 key clients worldwide, the publication covered multiple different topic issues; in my case, they probed my mind for my thoughts on insight, innovation, creativity, transformation, and disruption – and the role of a futurist in guiding organizations forward.

Back in 2008, just before the global economic meltdown, Credit Suisse (just purchased by UBS) interviewed me for its’ global client publication Bulletin. Distributed to 150,000 key clients worldwide, the publication covered multiple different topic issues; in my case, they probed my mind for my thoughts on insight, innovation, creativity, transformation, and disruption – and the role of a futurist in guiding organizations forward.

I was reminded of this interview when I was on stage last week for a financial services organization, in that a good part of my talk revolved around the next-generation financial consumer and the financial planner/wealth manager/investment advisor. In the Credit Suisse article, this particular comment resonated:

How do you personally innovate so that you always have a new message?

A lot of it comes with just observing what’s going on in one industry compared with others. Many trends are similar. And, I have the luxury of time and can just relax and think a lot. That is my job. A huge factor is that I have two sons, ages 12 and 14, and I work at home and often just watch them. You can really figure out the future by watching what children and young adults do, and then ask- ing yourself, why they do it. That really helps to understand where the future is heading.

My sons are now soon to be 28 and 30, and I still watch them as a unique method of understanding and working with the future, combined with the massive research dump that I take while preparing for any keynote.

And at a financial industry last week in California, the story of my youngest son actually became a part of my keynote, where I used him to paint a picture of just how different this generation is – in their relationship with money investments, the advisory role, and their expectations within the financial services. My son Tom? He’s a wealth management advisor, insurance broker, and financial manager. While being awfully proud of him, I also marvel at his unique relationship with the industry and his expectations.

Financial service organizations need to understand it’s no longer business as usual – this next generation is just so different it is staggering. In the context of that, the issue of high-tech-high-touch becomes more important than ever before. Consider this clip:

I expanded on this a little bit more during the Q& section that followed.

This got me thinking – there is so much happening here at a speed that many organizations don’t truly understand what is happening. With that in mind, I’ve reworked my basic financial keynote description to something a little more specific.

Keynote: The Future of Financial Services and the Next Generation Financial Consumer and Financial Advisor

There is no such thing as cash. The concept of float has disappeared. Everything is instant and accelerated expectations are the norm. DIsurptive ideas are everywhere – and everything financial is mobile. Those trends and much more are the focus o this fast-moving keynote by Futurist Jim Carroll. jim’s financial services clients include T. Rowe Price, Manulife, New York Life, TD Bank, Fidelity Cayman, American Fidelity, Lincoln Financial Group, and many more.

The trends impacting the banking, financial, investment, and wealth management industry are staggering in scope. The arrival of fast, new, nimble competitors is driven by the speed of innovation and the scope of the opportunity with FinTech leading to massive business model disruption. A collapse of attention spans driven by the next generation of financial consumers and an overwhelming preponderance of short attention spans. The acceleration of the industry to the speed of Silicon Valley as technology takes over every single aspect of the industry. The return of the potential for disintermediation with a vengeance, with sudden new challenges to existing distribution and broker channels. The arrival of a new generation that does not understand the concept of ‘float’, and who expects to be able to apply for an automotive loan and receive approval in under 45 seconds – through their mobile device – and then get instant insurance coverage at the same speed of instantaneity. Not to forget the sudden and instant arrival of A.I. with tools like ChatGPT – what happens when generic financial questions can be easily and somewhat reliably answered by a bot?

Leading financial organizations need crisp insight into the trends which are redefining the sector, and the innovation pathways that will provide opportunities for growth and transformation. Worldwide, they’ve been turning to Futurist Jim Carroll for that insight – his client list boasts many of the most prestigious organizations in the world. Whether it’s an internal senior leadership meeting, financial services industry conference, broker or distribution network sales meeting, or private wealth management strategy session, Jim Carroll is known worldwide for his ability to outline the fast trends impacting the financial industry now and into the future. He recently spoke for the family offices of the world’s wealthiest families at a private, invitation-only event in Athens, Greece, with several trillions of dollars of wealth represented in the room.

Jim Carroll has been helping financial organizations in the world understand the tsunami of change that is underway. In his keynote he will put into perspective the real trends impacting the future of financial services, offering critical insight into the key innovation and leadership strategies in a time of disruptive change.

GET IN TOUCH

Jim's Facebook page

You'll find Jim's latest videos on Youtube

Mastodon. What's on Jim's mind? Check his feed!

LinkedIn - reach out to Jim for a professional connection!

Flickr! Get inspired! A massive archive of all of Jim's daily inspirational quotes!

Instagram - the home for Jim's motivational mind!