“Can you envision the types of companies that will be on the dow in 2030? I can!” – Futurist Jim Carroll

Note the disclaimer though – generally, not specifically!

Let’s start here – most people presume that if you are a futurist, you must have an excellent track record at picking stocks on the market. I don’t!

That said, I will say that I’m pretty good at understanding what is going to happen ‘generally,’ not ‘specifically,’ hence the disclaimer in my quote. Despite having authored two books back in the 90s about using the Internet and technology to aid in the management of finances (“Canadian Money Management Online” and “Mutual Funds and RRSPs Online“), I’m not actively involved in doing so. To this day my wife and 27-year-old son, who works in the wealth management industry, are responsible for anything I might do. And a fun, hidden fact about my career as a futurist – I’m actually an accountant. A Canadian Chartered Accountant, or as are now known, a CPA. (I didn’t quite fit the matrix of the profession and pretty much abandoned it 40 years ago!)

That said, I think it’s fair for me to suggest that this is what we know about the Dow (or the NASDAQ, or the TSE, or other indices) of 2030 or 2040:

- there will be a number of companies on the index that won’t be there

- there will be a number of small companies that exist today that will be on it

- there will be companies that do not yet exist that will be part of it.

That’s been the reality ever since stock markets began; it doesn’t take a lot of expertise to make that type of observation.

It’s also fair to say that given the nature of the massive transformation and disruption of industries in the world today, we can expect a lot of volatility in the makeup of the Dow. History proves this to be the case – over time, companies have enjoyed such success for an increasingly short period of time.

Once-dominant companies always lose their dominance – consider what can happen in a short 9-year time span!

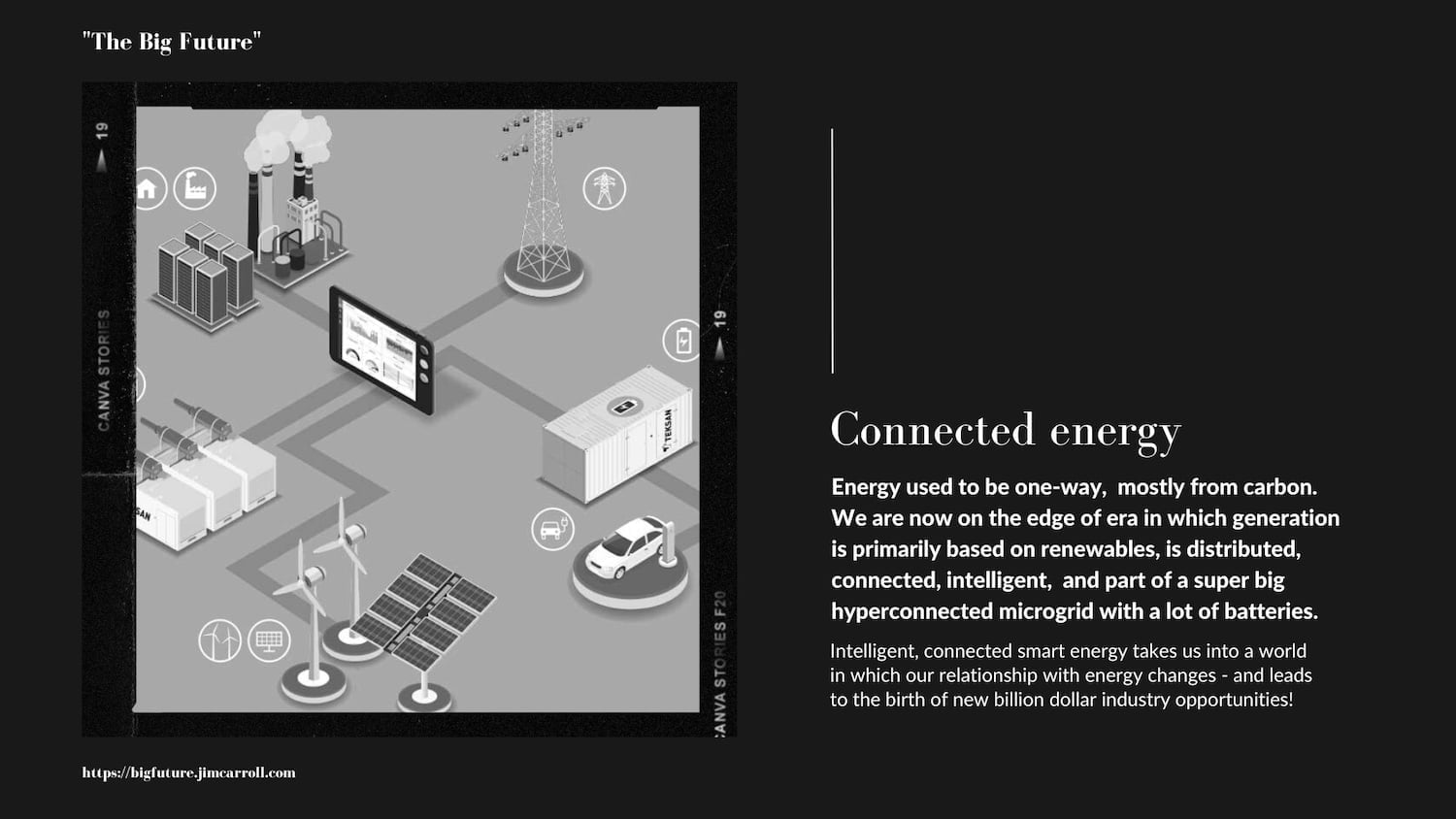

I was thinking about this while pulling together the next trend for my BIG Future series – “Connected energy.” It will appear next week.

This industry provides a really good example of what can happen – the energy production and distribution business, combined with the vehicle industry, is in the midst of a massive, significant change, and one of the most exciting aspects is what happens when the fundamental nature of the infrastructure that supports the use of energy undergoes a massive change.

Energy used to be one-way, mostly from carbon. We are now on the edge of an era in which generation is primarily based on renewables, is distributed, connected, intelligent, and part of a super big hyperconnected microgrid with a lot of batteries. Intelligent, connected smart energy takes us into a world in which our relationship with energy changes – and leads to the birth of new billion-dollar industry opportunities!

It is in such transitions that massive market volatility – and the makeup of stock market indices – change. Here’s what I know is going to happen, off the top of my head:

- The transition is undeniable. Carbon to renewables. Gas/diesel to batteries

- The spending and investment shift is undeniable. Oil is over, carbon cars are done.

- Going forward, everything is electric, renewables, and batteries.

- Renewables and tech blur as intelligent microgrids come to dominate the future and innovation

- Batteries are at the heart of so much of our future, and the science is moving fast

- Legacy auto and energy legacy companies/industries are at a disadvantage because tye don’t know how to be tech companies

- Even so, everyone is busy reinventing, establishing bold goals, and some winners are already emerging (Kia, Ford)

- But many legacy companies are trying to fight the future with FUD strategies (fear, uncertainty, doubt)

- FUD always fails – the future abhors leadership denial

- Asia is ahead of us – China in particular – when it comes to electric cars. There’s big disruption coming there.

- Electric infrastructure i.e distributed electric vehicle charging, and community microgrids – is key. Big bets are being made

- Your electric car is just a big battery and it is going to be an energy storage device in your home

- There’s a lot of money to be made in ‘electric car charging wait stations’ (retail, food, etc – people want something to do while they wait 15 minutes for a fast charge)

- Politics and community acceptance will play a huge role in innovation success – investment and regulatory matters.

- On that basis, the current culture wars around energy are a fool’s errand

- A lot of disruptive innovation and bolding thinking is yet to come – we’ve only just started

- Range anxiety is a misnomer: it doesn’t exist

- The next big thing? Billion-dollar market opportunity? Fully integrated home/EV/battery/vehicle microgrids

Imagine the TSX/Dow Jones of 2030. I can! It’s to be found in that type of disruption.

Because, as I have always said: “Companies that do not yet exist will build products not yet conceived, with materials not yet in existence, using methodologies not yet developed – and these will be sold to consumers who do not yet know that these new products and services will become a critical part of their life.

It’s in that type of thinking that you will discover opportunity!

GET IN TOUCH

Jim's Facebook page

You'll find Jim's latest videos on Youtube

Mastodon. What's on Jim's mind? Check his feed!

LinkedIn - reach out to Jim for a professional connection!

Flickr! Get inspired! A massive archive of all of Jim's daily inspirational quotes!

Instagram - the home for Jim's motivational mind!