“Ignore consensus!” – Futurist Jim Carroll

The recession-that-isn’t-a-recession has been coming at us for a long time – if you listened to the headlines, you would have been frozen in fear since 2017 if not earlier! Let me offer you just a few of the headlines that have appeared in a constant drumbeat of negativity, during the month of February each year.

2017

Europe-wide RECESSION warning: Economist says downturn will cause COLLAPSE of eurozone

express.co.uk, 25 February 2017

Canadians believe country in recession

The Toronto Star, 15 February 2017

Expert Column: Why the next recession could be looming

San Antonio Business Journal, 13 February 2017

2018

Head of world’s largest hedge fund says U.S. in a ‘pre-bubble phase’ with a 70% chance of recession

MarketWatch, 28 February 2018

With rates low, Fed officials fret over next U.S. recession

Reuters News, 23 February 2018,

2019

Bear market for stocks already underway, recession coming, says Crescat Capital

MarketWatch, 27 February 2019

JPMorgan signals caution on credit as recession concerns rise

American Banker, 27 February 2019

2020

Coronavirus Outbreak in Europe Increases Recession Risks for Eurozone — Market Talk

Dow Jones Institutional News, 28 February 2020

Coronavirus, recession fears wipe $12 trillion from markets

Herald Sun – Online, 28 February 2020

2021

Recession takes hold in Europe as pandemic is on the rise in some regions

MarketWatch, 26 February 2021

‘We are now in a recession, but how quickly can we come back from it?’

Gorey Guardian, 13 February 2021

2022

Brace for more volatility, European recession

The Australian – Online, 18:40, 28 February 2022

Fallout fuels global recession fears

The Australian, 24 February 2022

And then… came the US jobs report last week which continued to show an economy with massive resilience. Oops!

2023

‘Stunner’: After massive surge in January jobs, PNC pushes recession likelihood past mid-2023

Houston Business Journal, 6 February 2023

Yellen: “There is no recession when unemployment is at more than a 50-year low”

CE NoticiasFinancieras, 6 February 2023

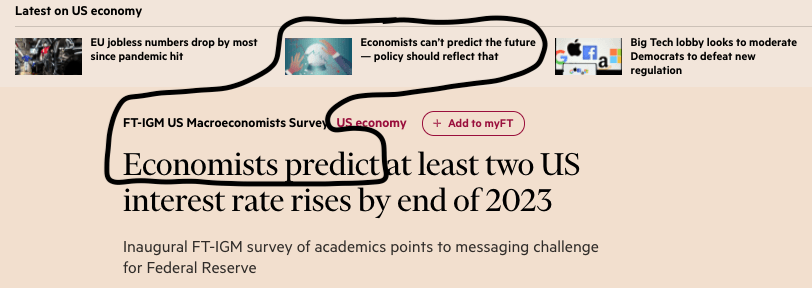

You can expect headlines, for the next ten years at least to predict the next imminent recession. If you let this mindset drive your mindset, you’ll miss out on the future, opportunity, and growth. Don’t let that happen. Consider this – consensus is usually wrong! My research tool, which allowed me to narrow in on the commonality of these headlines above, also gave me a fascinating article that perhaps summarizes the ridiculous moments in time in which we have found ourselves. The article should have been shared far and wide when it first came out – a lot of people would have saved themselves a lot of indecision and unnecessary pullbacks as a result!

MPs laughed as Belgian Gertjan Vlieghe, who sits on the Bank’s interest rate-setting committee, told them: “I’m never confident of any forecast”.

Belgian Gertjan Vlieghe, who sits on the Bank’s interest rate-setting committee, said he was ‘never confident of any forecast’

The economist was speaking to the Treasury Select Committee alongside his boss Mark Carney, who warned ahead of June EU’s referendum that a Brexit vote could trigger a recession.

Mr Vlieghe, formerly employed by DEUTSCHE BANK, added: “We are probably not going to forecast the next financial crisis, nor are we going to forecast the next recession.

“Models are just not that good. There isn’t one model which is right or wrong, and if only we had found a slightly better model then we wouldn’t have made the mistakes that we’ve made.”

He said there were “unrealistic expectations of what we’re going to get from economics in the next five years”. Bank Governor Mr Carney agreed: “Do we have a perfect model of the British household? No. We might understand that no forecast as a prediction is perfect, that there’s probabilities around that, but that’s not what people hear, and we need to do a better job of explaining.”

….The Bank’s chief economist Andy Haldane defended comments he made last month about his profession facing a Michael Fish moment….This was a reference to the BBC weather man failing to forecast the devastating storm which swept through Britain in October 1987.

Mr Haldane said: “Our problem is intrinsically more difficult than meteorologists’ and therefore perhaps the scope for us improving is somewhat more limited.”

WE’RE SO CLUELESS

Bank of England chiefs lose the plot and admit they won’t see next recession or financial crisis coming

thesun.co.uk, 21 February 2017

What happens when people are convinced that gloom is just around the corner? They max out their gloominess! The constant media drumbeat has them convinced that we are always just on the edge of awfulness! Data out of the US and Europe show that even while, right now, we see gloom despite continued relentless growth in the number of jobs and continued economic expansion. People are convincing themselves that we live in the worst of times – meanwhile, Joe Biden has presided over the faster period of jobs growth of any US President ever.

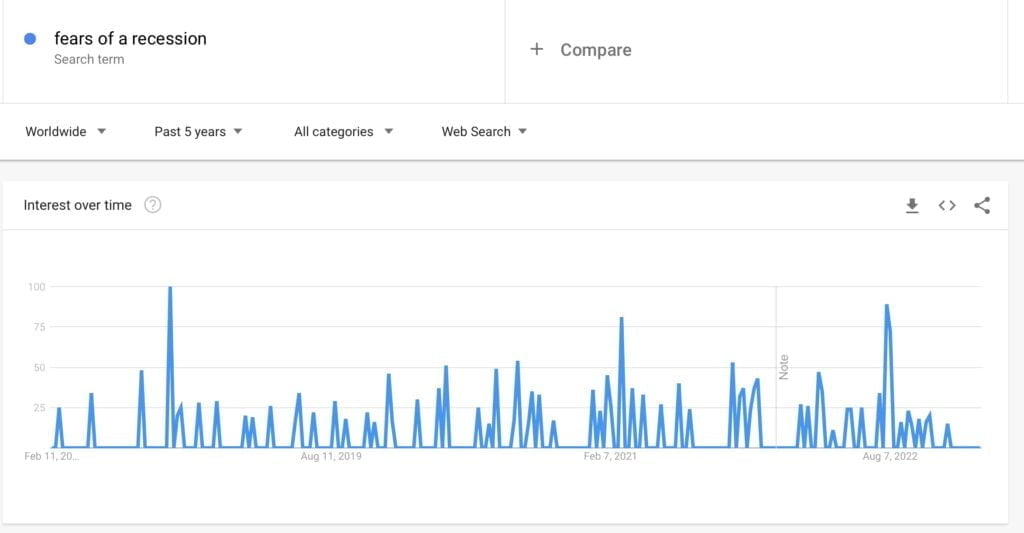

Meanwhile, people have been searching for the phrase ‘fears of a recession‘ since, well, forever!

I really don’t think the so-called experts know what is going on. That’s why this quote which I put together a few years ago is one of my favorites!

Is this true? Let me offer evidence as Exhibit A:

Ignore consensus! It’s good for you! Because otherwise, as I wrote Trend 6 of my “23 Trends for 2023″ series: “Opting out,” the consensus has been that “you’d better hunker down, scale back, slow down, take it easy, be cautious, reduce spending, defer our actions, wait it out, take things slow, put things on pause.”

And as I wrote in that post:

And that is just plain idiotic. History tells us so – because those who choose to opt out of conventional wisdom are those who win.

The trend that will unfold in 2023 has to do with the decision by many to choose not to participate in the current or upcoming recession, economic downturn, or whatever we want to call this period of economic uncertainty.

Ignore consensus! Choose growth!

GET IN TOUCH

Jim's Facebook page

You'll find Jim's latest videos on Youtube

Mastodon. What's on Jim's mind? Check his feed!

LinkedIn - reach out to Jim for a professional connection!

Flickr! Get inspired! A massive archive of all of Jim's daily inspirational quotes!

Instagram - the home for Jim's motivational mind!