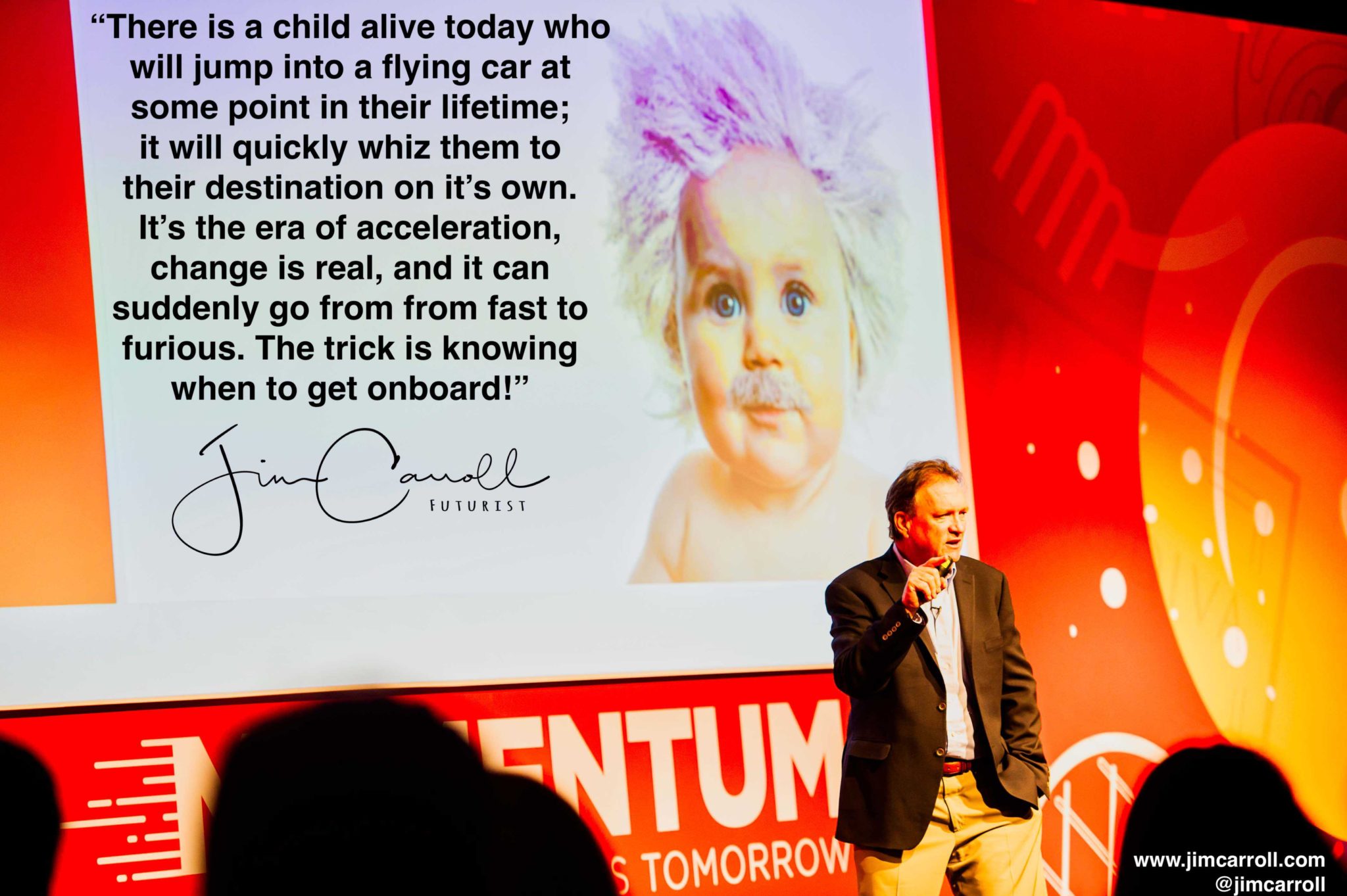

“The future happens slowly, and then, all at once!” – Kevin Kelly, Founding Editor at Wired magazine.

That, in a nutshell, was the modern day leadership dilemma that I presented to the CEO and senior team of a major company in the US financial services industry, at their corporate meeting last Monday in Dallas. Before I met with them, I put together my early morning “motivational quote of the day” and came up with this observation.

(Learn more about these daily quotes here – and take part by following me on various social networks!)

I put the quote together that morning based on my slide deck for the day: I was covering the key trends which would impact the world of insurance, banking, wealth management, investment advisory services and more going forward. And here was the big issue I was challenging them with that was the sub context of my talk – when it comes to the future, the big challenge is not necessarily knowing what the trends are — it’s increasingly, ‘when are they going to happen?’

We might have any number of trends which will impact financial services going forward – artificial intelligence, blockchain, disintermediation, robo-advisors, the acceleration of expectations, the emergence of new competitors, social-network driven wealth management and more. Yet, when might any of these trends become real and have a significant, disruptive impact? That can be a bigger issue than the trends themselves!

Consider one of the most overwhelming and challenging trends in the industry — will direct broker relationships survive in a world in which consumers are doing more and more online? It’s a trend known as “disintermediation,” and I’ve been speaking about it on stage for close to 25 years. Read my post from 10 years ago about the potential for change in the wealth management industry, when I did a talk for the National Australia Bank!

“Disintermediation” is the potential for individuals to bypass a relationship with a financial professional – such as a wealth management or investment advisor — by doing things on their own utilizing the Internet. It’s the idea that people will buy insurance directly, and thereby bypass any sort of relationship with an insurance broker. or, that they won’t use a wealth management advisor, because they believe they will be able to make better decision on their own – and thereby, cut out a commission-oriented relationship.

We’ve talked about disintermediation in the industry for a long time, and while it has happened to a degree, there are still many large firms that still have in place a business model that involves a broker network. Will it ever change that model? And if so, when? And how do we continue to deal with that potential reality?

That was part of the focus of my talk in Dallas. The trends in the wealth management, insurance and financial services industry are stark. In a nutshell:

- how people search for financial services is changing

- loyalty is declining

- geography is collapsing

- competition is increasing

- relationship building is not always done in person

- attention spans are collapsing, and with that, the foundation of interaction

- Moore’s law continues to accelerate the structural change within the industry

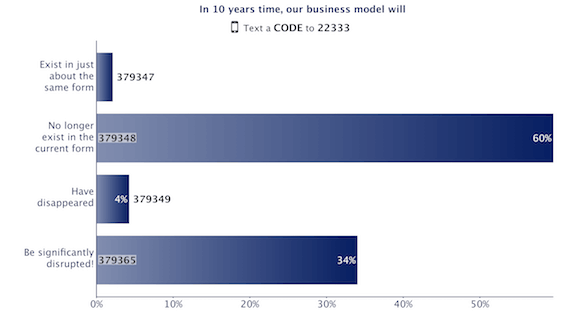

In my keynote, I covered these and many more future trends, in order to outline the fact that in 10 years time, the very nature of the industry, and the business model in place, might no longer look the same. I ran a few online, interactive text message polls with my audience, as I do in all of my talks, and the senior executives in the room certainly agreed with me. This is what they responded with:

From that point, my talk took at a look at innovation opportunities to ensure that the broker, advisor, and others would play a powerful role into the future despite the potential for business model change. And the fact is, there is a lot of potential here, but it involves keeping up to date with the high-velocity expectations of today’s financial consumer.

They are influenced with wealth management decisions through the social networks in which they participative – Reddit is their Bloomberg!

How so? One of the most powerful methods is to align to the significant behavioural change introduced by the next generation client – today’s 20 to 25 year old financial consumer. They live in a different world – it’s all mobile, instant, interactive, and fast. They expect to able to get approval for a mortgage or car loan online in 45 seconds or less. They want instant, up to date summaries of their financial position through their iPhone. They are influenced with wealth management decisions through the social networks in which they participative – Reddit is their Bloomberg!

But its’ not just innovating with this new client demographic – it also involves innovating with your own broker channel as well. Those of that age group who work within the financial services industry are fundamentally different too, in that they live in the same instant, short attention span, fast moving world. They expect to be able to do things fast, find clients fast, support those clients fast – and generally, adopt new ideas faster!

I’m getting a lot of hands on experience e with this new generation, in that my 23 year old son now works for a wealth management firm, similar to the one that I did my talk for in Dallas. He is busy building a career in the industry, at the same time that the industry is in the midst of massive potential upheaval. Will he be disintermediated? If the company that he works for does the right things, I don’t think so!

To that end, I spoke to my client last week about the reaction of the individual who hired him. She’s been in the industry for 35+ years, and has built a very successful wealth management firm. I understand that she was at a conference, and was speaking about some of the unique things she was doing to reach out to today’s new type of client.

Her response? “I hired a 23 year old!”

Brilliant! And that’s one of the key innovation success factors going forward – you can innovate in the context of a fast moving industry, by ensuring that you align yourself to todays’ fast moving client and employee. Generational innovation – understand it, and take advantage of it.

That’s one many trends I covered in my talk in Dallas last week. The future can often happen slowly – but can quickly happen all at once, particularly with the next generation!

GET IN TOUCH

Jim's Facebook page

You'll find Jim's latest videos on Youtube

Mastodon. What's on Jim's mind? Check his feed!

LinkedIn - reach out to Jim for a professional connection!

Flickr! Get inspired! A massive archive of all of Jim's daily inspirational quotes!

Instagram - the home for Jim's motivational mind!